Insurances Accepted:

Please feel free to discuss the details of your insurance coverage with the Hospital’s Discharge Planning Department.

Referrals: Every patient is assigned a Case Manager through the hospital’s Discharge Planning Department. The Case Manager serves as a liaison between the hospital and our health care center, ensuring a fast and streamlined referral process. Referrals are accepted twenty-four hours a day, seven days a week. In fact, an admission can occur as quickly as one hour from the time of referral. To make a referral to Salter HealthCare, simply call the Discharge Planning Department at the patient’s hospital. You may also call the Salter Central Admission Line directly at (781) 729-2200 to discuss a patient or obtain more information.

The Medicare Part A insurance will pay up to 100 Days if item 4 above is determined to be required for that length of time. However, it is common that the Medicare Part A insurance stops paying for services well before the 100 day maximum when custodial services are needed.

Skilled services are made up of two components that can be given together or separately. One of the components is therapy. Therapy consists of physical, occupational and speech. If the patient is receiving a combination of any one of the therapies and showing improvement than in most cases it is considered skilled. The other component is nursing. If a patient requires a nursing service that can only be delivered by a professional nurse than in most cases it is a skilled service. Custodial Services relate to bathing, grooming, dressing, feeding and other activities of daily living provided to the patient.

This decision is made by the professionals providing the services at the Skilled Nursing Facility.

If a patient’s condition has improved to the point that services of a skilled professional such as a nurse or therapist are no longer needed, then, in most cases the Medicare Part A insurance will stop paying for the stay at the Skilled Nursing Facility. For example, if a patient suffered a fractured hip and with therapy reached their full therapeutic potential, required no skilled nursing services and yet remained in the nursing facility, Medicare Part A insurance would end on the last day of therapy.

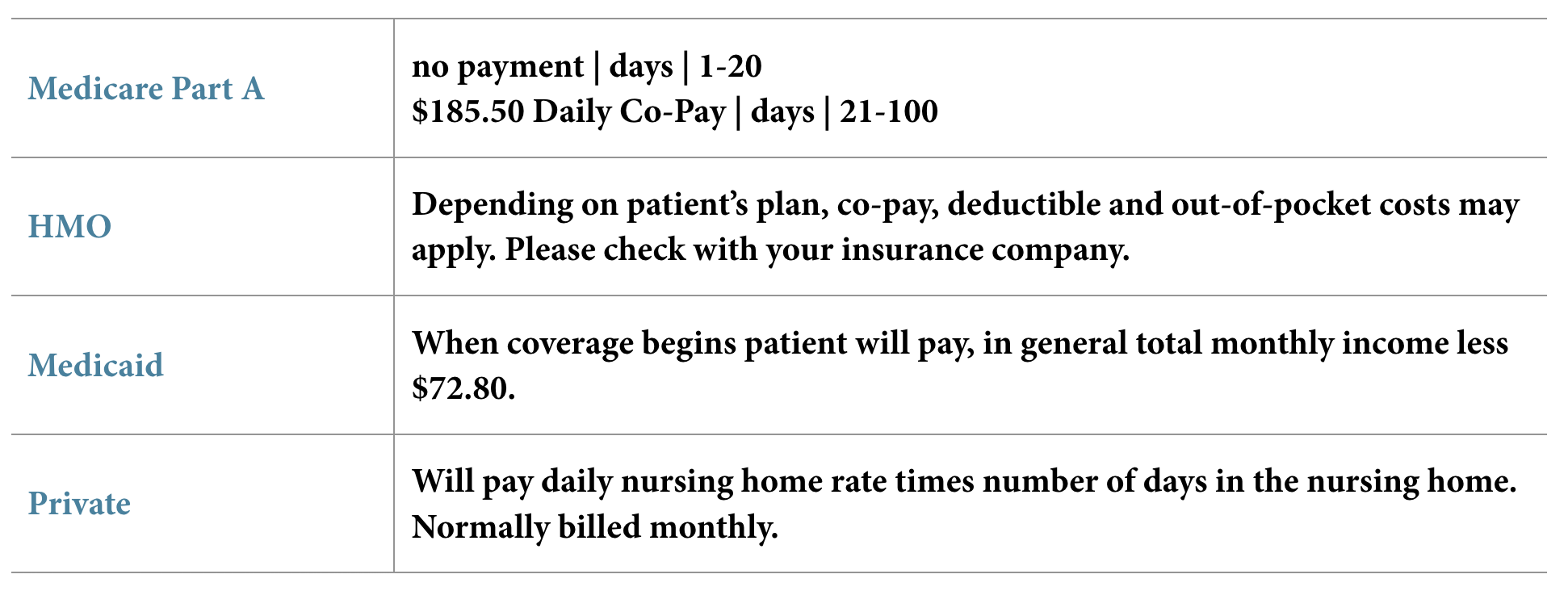

From day 1 to day 20 the patient does not have to pay anything to the nursing home. From day 21 up until Medicare Part A coverage ends or the 100 day maximum is reached the patient will have to pay a co-payment to the nursing home. The co-payment is $185.50 per day for calendar year 2021. This amount is set by the Federal Government and changes each January.

In many cases the Skilled Nursing Facility will take the co-insurance information and bill the company. However, each insurance plan is different and in many cases the insurance will not pay the full co-payment amount. For example: for 2021

Co-insurance | $185.50

Co-Insurance Pays | 80%

Patient is responsible to pay the nursing home | $37.10 per day

Most HMO’s require pre admission approval before the patient can be admitted to a Skilled Nursing Facility. Once the patient is approved most HMO’s will stay in daily contact with the Skilled Nursing Facility to monitor the patient’s progress. At some point the HMO Case Manager will inform the Skilled Nursing Facility that the HMO insurance coverage will be ending. A notice will be given to the patient stating the last day of HMO coverage.

Most HMO’s approve a skilled stay in a Skilled Nursing Facility. However, once the HMO ends the coverage and if the patient remains in the Skilled Nursing Facility, it will become the patient’s responsibility to pay the Skilled Nursing Facility.*

*Depending on their insurance plan, a patient may be responsible for a co-pay, deductible, or out-of-pocket payment. Call your customer service department at your insurance company to get more information.

Medicaid is a program administered by the State for patients who are financially and medically eligible for nursing home services. Patients who are eligible for Medicaid will have a portion of their room and board paid by the Medicaid program.

The patient or someone designated by the patient must file a Medicaid application with the Division of Medical Assistance for the Commonwealth of Massachusetts in order to determine if you are eligible for Medicaid. For additional questions/concerns, you may call the Medicaid Office at 800-841-2900.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.